Top Accounts Receivable Tools for 2026: Complete Comparison Guide

A lot has been written about optimizing cash flow.

For good reason, we think — given how, for some businesses, opportunities to free up cash might be hiding in plain sight.

Moreover, in the last few years, we saw the likes of a global pandemic, talks about a looming recession, and ongoing geopolitical tensions, not to mention disruptions in global supply chains — highlighting the need for businesses to build cash reserves.

These economic downturns also exposed the limitations of traditional approaches to accounts receivable. On an average, businesses in the U.S. reportedly have 24% of their monthly revenue tied up in accounts receivable.

To put it plainly, chasing late-paying customers has overburdened collection desks. Staying on top of receivables, following up on overdue payments, and reconciling them are easier said than done.

This is where an Accounts Receivable (AR) software comes into play. These tools bring enterprise-level automation into the picture, equipping finance teams with advanced billing, collections, customer communications, and reporting capabilities.

We’ve done the groundwork, and we’ve got our pick of the top accounts receivable software out there.

Quick summary: Top AR software

- Accounts receivable software is an automated financial tool that is used by businesses to manage their incoming payments. It includes the automation of invoice generation and payment reminders, to ensure customers pay on time.

- We share the top features in 10 of the best accounts receivable software, which are — Zenskar, Upflow, Bill, Invoiced, Quadient, Blackline, Freshbooks, Sage 50, Tesorio, Xero, HighRadius, and Melio.

- How do you select an AR tool that suits your business needs? Apart from looking at the pricing, you also need to consider the following factors: automation, integration capabilities with popular third-party apps, an all-in-one dashboard, multiple payment options, real-time reporting, and reliable customer support service.

What is an accounts receivable software?

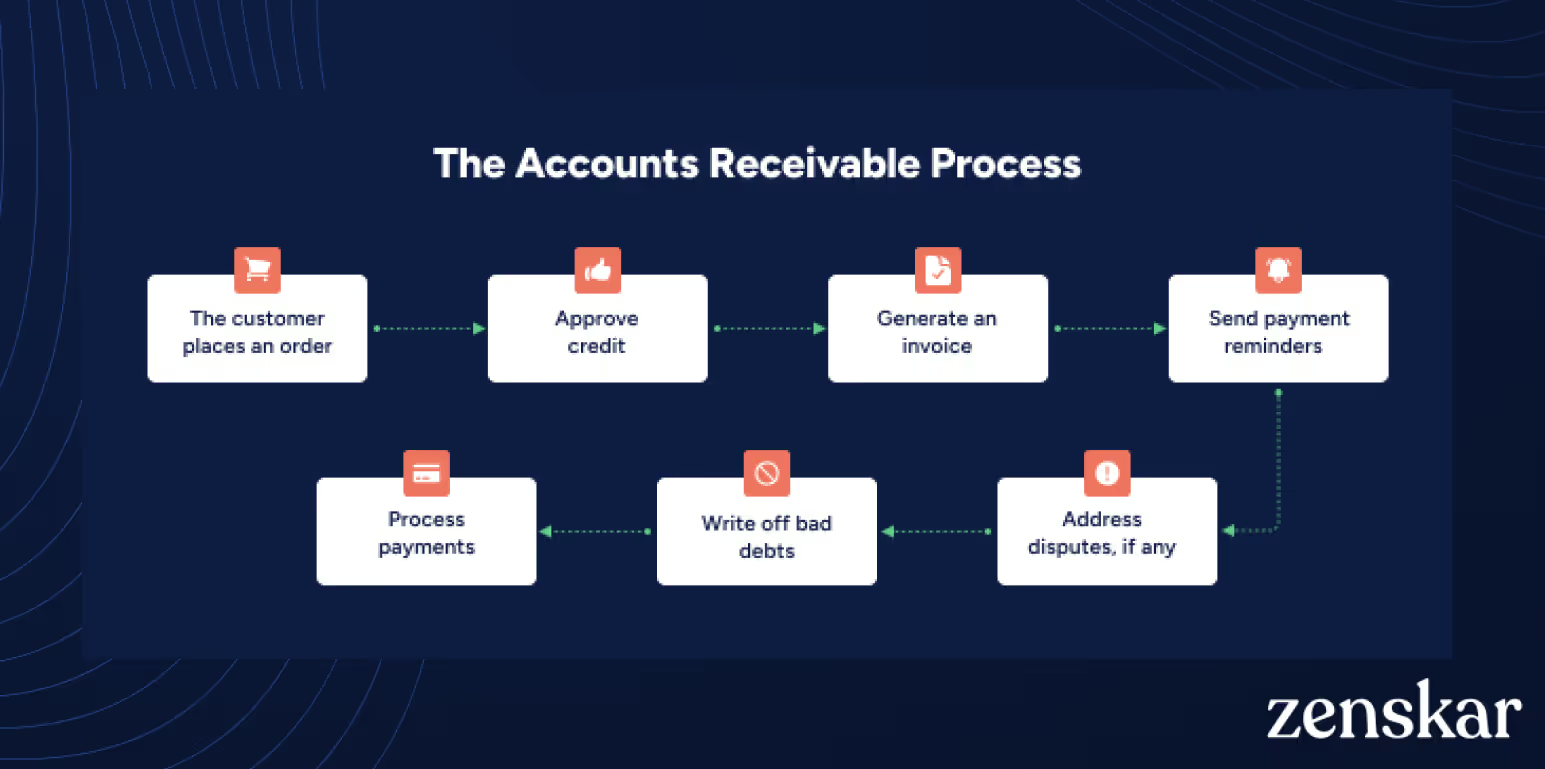

An accounts receivable software is a tool that is used to manage the money you are owed for the products or services that you offer to customers. The software is used to manage your receivables process, ensuring that you get paid on time (and in full).

With an accounts receivable software, businesses can automate and simplify many of the tedious, manual tasks in the accounts receivable process.

This includes generating invoices, tracking payments, auto-processing payments, reconciling them, and managing collections.

The accounts receivable automation software is a critical tool to ensure timely invoicing for your business and monitor payment statuses in real-time.

With this software, you can not only send out invoices effortlessly, but you can also set up reminders for overdue payments, follow up with late-paying customers using automated communications, and generate aging reports.

These aging reports help you prioritize collection efforts by allowing you to easily track down late-paying clients and bad debts — as well as identify any potential issues that are impacting your cash flow.

Benefits of using AR software

1. Improved cash flow

- Faster payments: Speeds up invoicing and payment processing for quicker cash inflows.

- Better cash flow forecasting: Real-time visibility into outstanding invoices and payments improves forecasting accuracy.

- Reduced days sales outstanding (DSO): Streamlined collections shorten the average payment cycle.

2. Reduced errors and increased accuracy

- Automated data entry: Minimizes manual input, reducing mistakes and inconsistencies.

- Enhanced data accuracy: Reliable automated processes produce more accurate financial reports.

- Less manual work: Frees staff from tedious tasks, enabling focus on strategic priorities.

3. Enhanced customer experience

- Improved communication: Facilitates clear, timely updates about invoices and payments.

- Personalized service: Enables tailored communications based on customer data and history.

- Modern payment options: Supports diverse payment methods to meet customer preferences.

4. Better visibility and control

- Real-time data: Provides instant insights into AR metrics for informed decision-making.

- Comprehensive reporting: Offers detailed analytics on AR performance and trends.

- Improved compliance: Maintains accurate, auditable records supporting regulatory adherence.

Challenges with manual AR processes

Manual AR and collections work is a real drain—full of slow processes, mistakes, and constant follow-ups that wear down your team. It hurts cash flow and holds back growth. Automation cuts through all that, making things smoother, more accurate, and easier to scale. It frees your team to focus on what really matters and keeps customers happier. In the end, you get healthier cash flow, clearer financial visibility, and the confidence to push your business forward.

Top 10 accounts receivable software

1. Zenskar

Best for: Enterprises with complex billing models who need AI-powered AR automation and no-code flexibility. Ideal for businesses requiring custom workflows and scalability without heavy engineering involvement.

Zenskar is a flexible tool that automates billing and streamlines revenue recognition for companies with complex billing and pricing models.

Right from customizing every aspect of your billing to automating the revenue side of your financial operations, Zenskar’s no-code billing infrastructure is designed to help you automate payment collection and improve cash flow (without relying on an engineer’s bandwidth).

From generating invoices to following up with payment reminders and tracking payment receipts, Zenskar’s advanced functionalities are designed to ensure that you collect payments in days, not weeks.

Features that stand out:

- Automated payment reminders and dunning sequences

- Branded templates for different email communications

- Invoices and payment reminders can be added as email attachments

- Customer segments can be set up based on customer aging, payment history, or geography

- A single dashboard to monitor overdue invoices, aging reports, and DSOs

Pricing:

Get in touch with our team here to discuss pricing plans that are best suited for your business needs and workflows.

2. Kolleno

Best for: Enterprise finance teams seeking a unified platform for accounts receivable, collections, and reconciliation. Ideal for businesses looking to streamline cash flow with automation and real-time insights.

Kolleno is an end-to-end accounts receivable automation platform designed to eliminate manual workflows across credit control, collections, and reconciliation. It leverages AI and smart workflows to automate payment reminders, allocate cash accurately, and improve customer communication.

Kolleno’s all-in-one platform integrates seamlessly with leading ERPs and offers a 360° view of receivables, empowering finance teams to focus on strategy, not chasing payments.

Features that stand out:

- Smart, AI automated workflows for collections and follow-ups

- Real-time cash allocation and reconciliation

- Integrated omnichannel communication (email, SMS, call)

- Customizable customer payment portals with click-to-pay options

- Centralized dispute and invoice tracking dashboard

Pricing: Contact Kolleno’s sales team to get a customized quote tailored to your business size and needs.

3. Invoiced

Best for: B2B companies with complex invoicing needs and multi-channel payment acceptance. Suited for businesses that want customizable workflows and strong integration with platforms like QuickBooks and Xero.

This online billing and invoicing solution — Invoiced, manages complex B2B-specific payment and invoicing scenarios.

Apart from automated invoice delivery, this platform provides customizable workflows and integration capabilities to suit different business needs.

Features that stand out:

- Leverages the Invoiced Business Network to speed up B2B payments

- Accepts payment through direct debit (including modes like ACH and Bacs), credit card, and virtual card

- Integrations with popular third-party platforms like Xero and QuickBooks

- Real-time reporting across the entire invoice-to-cash lifecycle

Pricing:

Essentials: $39/month

Growth: $199/month

Premium: $499/month

Enterprise: Get in touch with their team for customized pricing plans.

4. Quadient

Best for: B2B finance teams at mid-market to enterprise level seeking AI-powered cash application and automated dispute management. Useful for businesses that want end-to-end order-to-cash automation with predictive analytics.

Quadient AR – by YayPay, is an accounts receivable automation platform made for B2B finance teams.

The platform automates the order-to-cash cycle, ensuring high-value customer interactions and accelerating cash flow.

Features that stand out:

- Smooth integrations with ERP systems

- Automates dispute resolutions

- Provides an AI-powered cash application

- Tracks DSO and aging in real-time

- Utilizes machine learning algorithms to identify payment trends

Pricing:

Reach out to their team to find out about their pricing details.

5. Blackline

Best for: Large enterprises requiring finance and accounting automation, particularly those focused on credit risk management and centralized dispute resolution. Ideal for organizations needing sophisticated journal entry automation and operational insights.

Blackline is a finance and accounting automation tool that leverages powerful intelligence and automation capabilities to streamline the invoice-to-cash process.

By centralizing the end-to-end receivables process, Blackline improves the decision-making capabilities of collections and risk teams as well as C-suite executives.

Features that stand out:

- Facilitates proactive credit and risk management

- Automates end-to-end journal entry processes

- Decision intelligence captured from operational data

- Tracks and measures the impact of disputes

Pricing:

Contact their team to get a quote.

6. Sage 50

Best for: Small to mid-sized businesses looking for traditional accounting software with AR features and bulk invoicing capabilities. Best for companies wanting robust financial management along with basic AR automation.

Sage 50 is a powerful accounting software that comes packed with robust financial management solutions.

From automating invoicing to using projections to anticipate future cash flow, Sage 50 helps businesses stay on top of their receivables.

Features that stand out:

- Sends invoices in bulk to multiple customers at once

- Detailed analytics and reporting capabilities

- A customizable dashboard view that can be filtered based on the type of transaction or date range

- Collect payments faster with the online ‘Pay Now’ invoice feature

Pricing:

Pro accounting: $595/year

Premium Accounting: $1,023/year

Quantum Accounting: $1,728/year

Payroll bundles: Explore their bundle pricing here.

7. Tesorio

Best for: Growing companies focused on cash flow forecasting and predictive collections, leveraging machine learning. Great for finance teams that want collaborative workflows and intelligent payment follow-ups.

The accounts receivable automation software, Tesorio, has automated collections forecasting and smart workflow tools powered by machine learning and data analytics.

Tesorio has automated dunning functionalities that let you send payment reminders based on the type of customers and the age of invoices.

Features that stand out:

- Click-to-pay button on online invoices

- Per-customer predictive models

- Matches multiple invoices to one customer

- Collaborative workspaces for teams to share notes and aggregate data

Pricing:

Contact their sales team for detailed pricing information.

8. Xero

Best for: Small businesses and growing companies that want user-friendly accounting with extensive third-party integrations and multi-currency support. Suitable for companies looking for simple invoicing combined with multiple payment options.

With Xero’s user-friendly accounting platform, you can simplify invoicing and ensure access to financial data anytime and anywhere.

Xero offers customers multiple payment methods, from direct debit to credit cards and more, accelerating accounts receivable for businesses.

Features that stand out:

- Integrations with 800+ third-party apps

- Enables transactions in various currencies

- Transaction fees can be passed on to customers in part or in full, or they can be paid only when a customer uses an online payment mode

Pricing:

Starter: $14.5

Standard: $23

Premium: $31

9. HighRadius

Best for: Large enterprises and global companies needing AI-powered AR automation with intelligent invoicing, prioritized collections, and deduction management. Best for organizations aiming to reduce DSO and optimize cash flow via automation.

HighRadius is an AI-powered accounts receivable automation software that automates routine tasks and empowers AR teams to focus on more strategic activities.

With features like cash application, intelligent invoicing, and collections management, HighRadius enables businesses to reduce DSO and optimize cash flow.

Features that stand out:

- Streamlines accounts receivable processes with AI-prioritized worklists

- Recommendations for data-driven business decisions

- Self-serve customer portal

- AI-powered deduction validity predictor

Pricing:

Contact their team for pricing details.

10. Melio

Best for: Small businesses and freelancers seeking a free, easy-to-use platform for payment scheduling, invoice tracking, and ACH transfers. Ideal for those who want to simplify AR without complex setups or high costs.

This user-friendly platform, Melio, simplifies accounts receivable processing and improves financial operations for smaller businesses, saving them time and money.

With features like invoice tracking, payment scheduling, and third-party app integrations, Melio helps businesses manage receivables and streamline their bookkeeping process effortlessly.

Features that stand out:

- Syncs incoming payments with invoices

- Free ACH transfers

- Invoices with a built-in pay button

Pricing:

The platform is free to use.

Key things to consider when selecting an accounts receivable software

While there is a host of AR automation software on the market, when it comes to choosing one — you need to first take your business needs into consideration while also taking into account capabilities such as automation, integration with third-party apps, an all-in-one dashboard, multiple payment options, detailed reporting, pricing of the tools, and customer support service.

Here are a few tips to help you make an informed decision:

- Ensure the platform offers automation capabilities, enabling auto-generation of invoices, payment tracking, dunning, and reconciliations.

- The tool should be able to integrate with your internal tech stack and other popular third-party software.

- It must be intuitive, offering a comprehensive dashboard to track the entire invoice-to-cash lifecycle.

- Choose a tool that enables multiple payment options, giving your customers the freedom to pay the way they want.

- Select a tool that provides detailed reporting and predictive analytics, along with credit risk management capabilities.

- While you need to consider the pricing of the tool, be sure to evaluate any hidden fees or additional charges that may apply.

- Opt for a tool that has reliable and quick customer support.

Collect and reconcile customer payments in days

This comprehensive guide to the best-rated accounts receivable software will help you inch closer to making the right choice for your business.

If you’re looking to break free from unsustainable and non-scalable billing processes, then Zenskar is the ideal choice for your business. We built Zenskar for businesses to experience the benefits of automated payment collection. Our advanced functionalities are enabling enterprises to improve their cash flow with automated invoicing and follow-up processes.

The best part? You can scale your debt communications with ease using an email software within your billing system.

Schedule a 1:1 demo with the team to learn how Zenskar can be a perfect fit for your business.

We launched our product 4 months faster by switching to Zenskar instead of building an in-house billing and RevRec system.

Frequently asked questions

For managing accounts receivable, you need to use a software that automates invoicing, payment processing, collections, and reporting. Accounts receivable software like Zenskar is designed to help companies accelerate client payments with automated payment reminders and advanced dunning capabilities.

AP AR software is accounts payable and accounts receivable software that is designed to eliminate the manual and time-consuming tasks involved in managing a business’s payables and receivables.

AR automation software is the accounts receivable automation software that is

used by businesses to automate and speed up the payment collection process. An AR automation software helps eliminate manual errors and mundane data entry tasks, which, in turn, speed up payments and reduce DSOs.

Invoicing tools focus on creating and sending invoices. AR software manages the full payment lifecycle, including tracking, collections, and reporting.

Yes, many AR solutions are tailored for small businesses with easy setups and affordable pricing. They help speed up payments and reduce manual work.

.avif)